Why Your Business Needs Passive Video KYC Solutions?

-

Reduced operational cost – automated & agentless

-

Superior user experience – seamless, quick, and secure

-

Compliance-ready & auditable – supports regulator audits

-

Future-proof – AI-driven fraud detection adapts to emerging threats

Built by Industry Experts

-

Automated video KYC - no human intervention.

-

AI-driven liveness & fraud detection - 100% authenticity

-

Reduced verification time to under 30 seconds

-

Plug-and-play API/SDK integration for easy deployment

Trusted by Leading NBFCs, Fintechs, and E-commerce Platforms

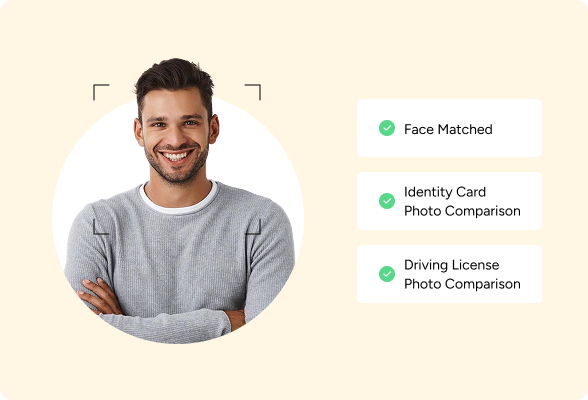

Passive Face Capture

Auto-detects faces without manual user interaction

Liveness Detection

Prevents spoofing, masks, and deepfakes

ID Document Matching

Verifies against government IDs

Speech-to-Text Conversion

Converts audio for compliance verification

OTP Validation

Confirms user consent and mobile verification (optional)

Fraud Detection Engine

Flags screen recordings, duplicate faces, and bots

Output Package

Video, images, match scores, transcripts, and risk indicators

How does Video KYC Work?