SprintVerify's KYC API: The Smart Choice for Your ID Verification Requirements

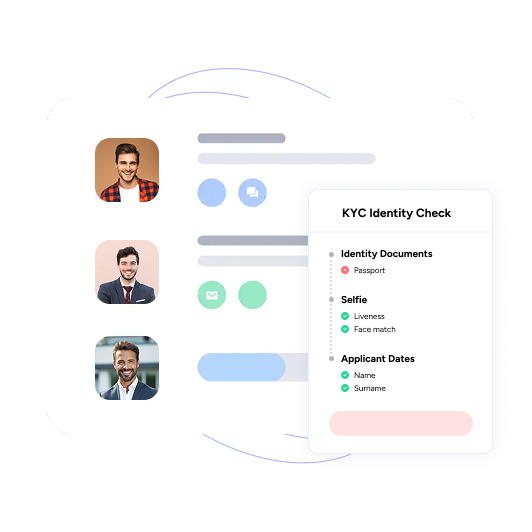

Simplifying Identity Verification

KYC Verification API makes the identity verification fast and easy for both the developer and the user. It is simple, easy to use, and ensures accurate, secure verification every time.

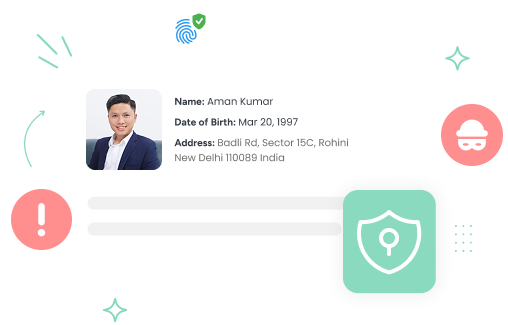

Combat Fraud with KYC Solution

KYC Verification API is the ultimate solution to prevent fraud and fake identities. It helps the institution detect and eliminate fraudulent attempts, enhancing stronger security and trust.

Accurate and Reliable KYC Solutions

KYC API verifies identities by matching personal details with government records. This process ensures accurate, trustworthy, and legally valid results, giving the institution and the user complete peace of mind.

Key Features of KYC Verification API

-

Verify and authenticate customer identity documents

Document Verification service securely verifies IDs like passports, driver's licenses, and national IDs using advanced technology for fast and accurate authentication.

-

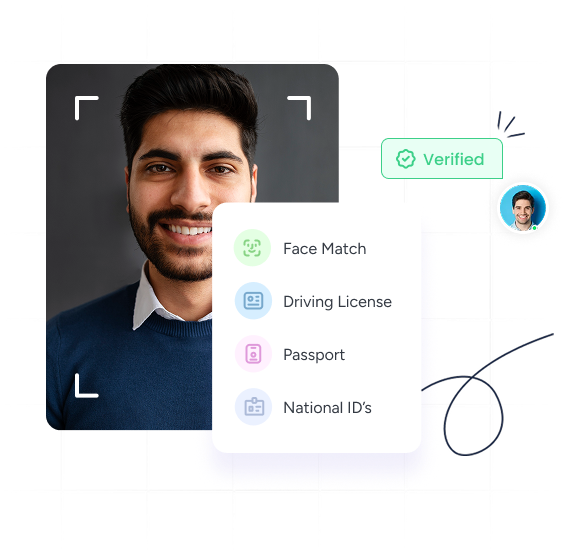

Secure and Easy Biometric Authentication

Enhance security with our biometric authentication solution. Our advanced biometric solution, such as fingerprint recognition, facial recognition, voice pattern, and iris scan, is used to verify customer identity quickly and accurately

-

Validate customer addresses for accuracy

Address Verification service enables businesses to validate customer addresses with precision and efficiency. By matching customer-provided addresses with official records and trusted databases, we ensure accuracy and authenticity.

KYC Solution: Industry Use Cases:

The Online KYC Check API simplifies identity verification, benefiting various industries such as-

Banking

Banking Insurance

Insurance Lending

Lending Ecommerce

Ecommerce Healthcare

Healthcare Real Estate

Real Estate Courier

Courier

APIs Under KYC Verification

Frequently Ask Question

Explore our FAQs to uncover the what, why, and how behind our verification solutions—and see how we're helping businesses onboard faster, stay compliant, and build trust in the digital world.

You have different questions?

Our team will answer all your quesions.

We ensure a quick response.