Benefits of SprintVerify’s Fraud Detection API

Effortless Fraud Prevention with Fraud Check APIs

Our Powerful fraud prevention APIs simplify the process of detecting and eliminating fraudulent activities. With a user-friendly interface, these APIs deliver accurate results, helping businesses and institutions strengthen their security with ease.

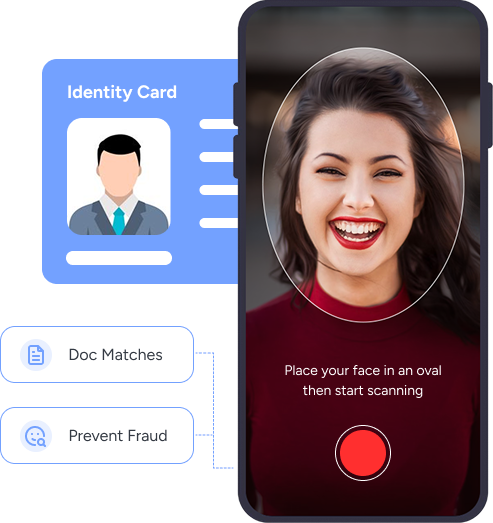

Enhanced Fraud Detection Solutions

Our Fraud detection API helps businesses to identify and prevent fake identities effectively. Using smart algorithms and data analysis, it strengthens security and prevents fraud effectively.

Trustworthy Fraud Risk Assessment

Our Fraud risk assessment verifies individuals’ identities by matching personal data with government records and transaction history. This process guarantees accurate, trustworthy, and legally valid results, providing peace of mind for the institution and the user alike.

Stop fraud in Real Time with SprintVerify's API

-

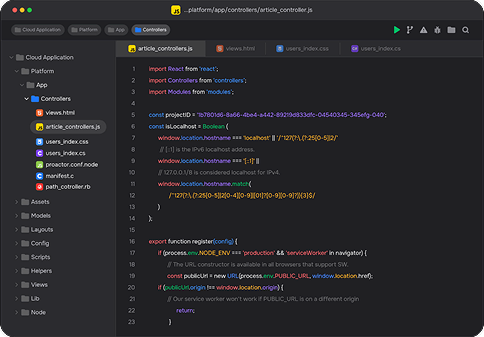

Robust Documentation

Detailed, timely documentation for your businesses, partners, and end-users, compliant and risk-reduced.

-

Ensuring Financial Security

Identify fraudulent or incorrect user information and flag suspicious transactions in real-time with SprintVerify's Fraud Check API, preventing losses and protecting your financial operations.

-

Effortless Integration

Easily integrate our Fraud Check API into your existing systems and workflows for seamless fraud prevention processes. You can start blocking fraud instantly with a user-friendly interface and a quick setup.

Leveraging Cutting- Edge APIs for Fraud Prevention

By leveraging our fraud prevention APIs, businesses can enhance their fraud detection capabilities and mitigate transaction risks effectively. Our comprehensive suite of APIs offers a reliable and scalable solution for businesses looking to safeguard against fraudulent activities.

Use Cases for Fraud Detection APIs

Explore Our Fraud Detection API across key sectors, such as Banking, Fintech, E-commerce, Insurance, and more.

Banking

Banking Insurance

Insurance Ecommerce

Ecommerce Healthcare

Healthcare

APIs Under Fraud Detection

Frequently Ask Question

Explore our FAQs to uncover the what, why, and how behind our verification solutions—and see how we're helping businesses onboard faster, stay compliant, and build trust in the digital world.

You have different questions?

Our team will answer all your quesions.

We ensure a quick response.