eKYC Simplified: Fast Digital Verification

eKYC Explained: Streamlining Customer Verification in the Digital Age

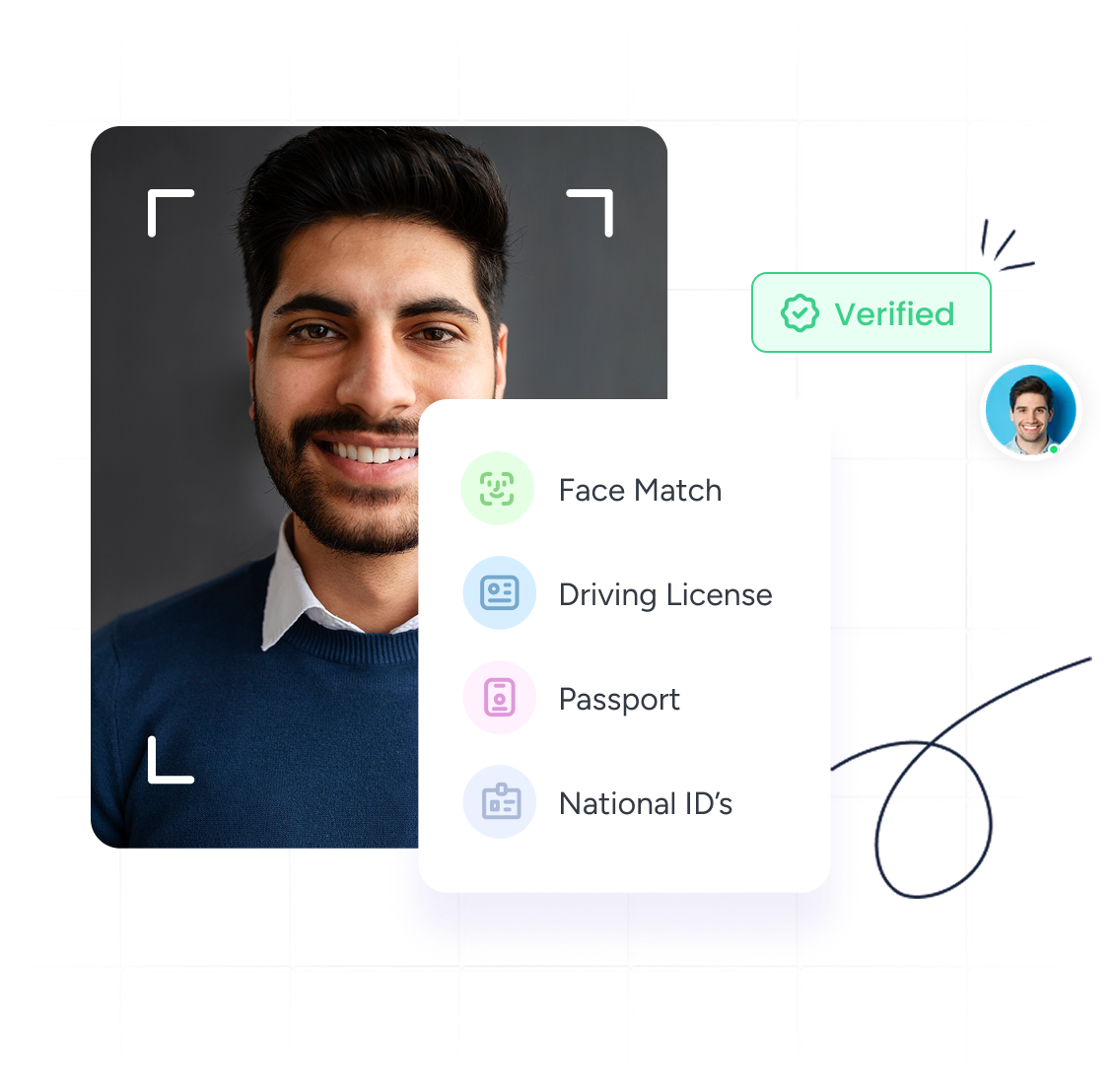

eKYC, or Electronic Know Your Customer, is rapidly transforming how businesses verify customer identities in the digital era. As a crucial component of secure online transactions and efficient user onboarding, eKYC enables organizations to authenticate individuals remotely without the need for physical documentation or in-person verification.

Unlike traditional KYC processes, which are often slow,

paper-intensive, and prone to human error, eKYC uses advanced

technologies such as artificial intelligence (AI), biometrics, and even

blockchain to streamline verification. This not only enhances customer

experience but also ensures compliance with regulatory standards in real-time.

In this blog, we provide a comprehensive overview of eKYC,

exploring its benefits, implementation technologies, regulatory considerations,

common challenges, and the future of digital identity verification. Whether

you’re a fintech startup, a bank, or an enterprise expanding your digital

services, understanding how eKYC works can give you a competitive edge

in a fast-evolving landscape.

Table of Contents

- What is eKYC?

- What Documents Are Required for eKYC?

- Benefits of eKYC

- Technologies Driving eKYC

- Challenges in Implementing eKYC

- Conclusion: The Future of Identity Verification is Here

- Frequently Asked Questions (FAQ)

What is eKYC?

eKYC, or Electronic Know Your Customer, is a digital process that allows businesses to verify customer identities remotely using advanced technologies. It eliminates the need for physical documentation and manual verifications by digitizing the entire process. This paperless approach ensures faster onboarding, enhanced security, and compliance with regulatory standards while providing a seamless user experience.

Key Features of eKYC

- Paperless

Process: eKYC eliminates the need for physical documents and manual

filing. Customers can upload their identification digitally, making the

process seamless and eco-friendly. This not only reduces operational costs

but also contributes to sustainability efforts.

- Remote

Accessibility: With eKYC, users can complete verification from

anywhere using their smartphones or computers. This accessibility is

particularly beneficial for rural areas where physical verification was

previously challenging due to logistical constraints.

- Enhanced

Security: Advanced encryption techniques protect sensitive data during

transmission. Biometric authentication ensures unique identity

verification that cannot be forged or tampered with. These measures

significantly reduce the risk of fraud and unauthorized access.

- Regulatory

Compliance: eKYC solutions adhere to global standards like AML

(Anti-Money Laundering) and CTF (Counter-Terrorist Financing), ensuring

businesses meet regulatory requirements effortlessly while maintaining

transparency in operations.

What Documents Are Required for eKYC?

The documents required for eKYC are minimal compared to traditional KYC processes due to its digital nature. Typically, you need:

- Aadhaar

Card: The Aadhaar card is central to most eKYC processes in India as

it contains both biometric and demographic data linked to an individual’s

identity.

- PAN

Card: Often used for financial transactions, the PAN card serves as

proof of identity and tax compliance in India.

- Passport

or Voter ID: These are alternative government-issued ID proofs that

may be required depending on the service provider or regulatory

requirements.

- Proof

of Address: Utility bills, rental agreements, or bank statements may

be requested if address verification is necessary for specific services.

- Recent Passport-Sized Photograph: Some institutions may require a photograph for record-keeping purposes.

In most cases, these documents can be uploaded online or verified via Aadhaar-based OTP authentication or biometric scans.

Benefits of eKYC

1. Faster Customer Onboarding

Traditional KYC processes often take days or weeks due to manual documentation and verification steps. eKYC automates these steps, reducing onboarding time to mere minutes. For instance, opening a bank account or applying for a loan becomes a hassle-free experience for customers while reducing administrative burdens on organizations.

2. Cost Efficiency

By digitizing the identity verification process, businesses save operational costs associated with physical documentation storage, manual labor, and infrastructure maintenance. Organizations can redirect these savings toward innovation and customer-centric initiatives.

3. Fraud Prevention

eKYC integrates biometric authentication methods such as fingerprint scanning and facial recognition alongside AI-powered fraud detection systems. These technologies ensure that only genuine identities are verified while minimizing risks like identity theft or document forgery.

4. Scalability for Businesses

Digital systems enable businesses to handle large volumes of customer onboarding requests simultaneously without compromising accuracy or efficiency. For example, financial institutions can onboard thousands of customers during peak periods without delays or resource constraints.

5. Improved Customer Experience

The seamless nature of eKYC ensures minimal friction for users while offering personalized experiences tailored to their needs. Customers no longer need to visit physical branches or submit extensive paperwork—everything happens at their fingertips.

Technologies Driving eKYC

Biometric Authentication

Biometric methods such as fingerprint scanning, facial

recognition, iris scans, and even voice recognition ensure unique

identification that is nearly impossible to replicate. These technologies

provide unmatched security while enhancing user convenience.

Example:

Behavioral biometrics analyze patterns like typing speed or mouse movements to continuously authenticate users based on their behavior—making it difficult for fraudsters to mimic legitimate customers.

Artificial Intelligence & Machine Learning

AI and ML algorithms analyze vast datasets in real-time to

detect anomalies, automate document verification, and flag suspicious

activities. These technologies significantly reduce manual errors while

improving accuracy.

Example:

AI-powered Optical Character Recognition (OCR) extracts data from documents like passports or Aadhaar cards with precision and speed—streamlining the verification process further.

Blockchain Technology

Blockchain provides decentralized storage for customer data,

ensuring tamper-proof records and secure sharing between organizations. It

eliminates risks associated with centralized data storage systems while

enhancing transparency.

Example:

Smart contracts on blockchain automate compliance checks while maintaining transparency in data handling processes.

Challenges in Implementing eKYC

1. Regulatory Compliance Complexity

Navigating diverse regulatory frameworks across regions can be challenging for businesses adopting eKYC solutions. For example, adhering to GDPR in Europe while complying with local regulations in India requires robust legal expertise and constant updates on changing laws.

2. Technological Infrastructure Requirements

Integrating advanced technologies like AI or blockchain into

legacy systems demands significant investment in both hardware and

expertise—posing challenges for smaller organizations with limited budgets. For

more details, check out SprintVerify’s

easy identity verification guide.

Conclusion: The Future of Identity Verification is Here

As digital transformation accelerates, ekyc has become a

vital tool for secure, fast, and compliant identity verification. By replacing

manual processes with real-time authentication through biometrics, AI, and

automation, ekyc enables businesses to onboard users quickly while maintaining

regulatory standards. As adoption increases across industries like banking,

insurance, and telecom, organizations must stay prepared for evolving data

privacy and compliance challenges. For companies seeking a reliable and

scalable solution, PaySprint offers some of the best ekyc services, helping

businesses reduce fraud, enhance customer experience, and stay ahead in today’s

digital-first ecosystem. For more details, check out KYC verification

methods explained.

Frequently Asked Questions (FAQ)

1. What is eKYC? For more details, check out digital onboarding insights.

eKYC (Electronic Know Your Customer) is a digital method of

verifying a customer’s identity using technology such as biometrics, artificial

intelligence, and online document verification. Unlike traditional KYC, it

eliminates the need for physical paperwork, allowing users to complete the

process remotely via smartphone or computer.

2. What documents are required for eKYC?

The documents needed for eKYC are fewer and can be submitted

digitally. Typically, you’ll need:

- Aadhaar

Card (linked to a mobile number)

- PAN

Card (for financial transactions)

- Passport

or Voter ID (alternate ID proofs)

- Proof

of Address (utility bill, rental agreement, or bank statement)

- Recent

Passport-sized Photograph (if required by the service provider)

3. Is eKYC safe and secure?

Yes, eKYC is designed with security in mind. It uses

end-to-end encryption to protect data in transit, biometric verification to

ensure identity authenticity, and AI-powered fraud detection systems to spot

suspicious behavior. These measures make eKYC highly secure and

tamper-resistant.

4. Who is eligible for eKYC?

Any Indian citizen with an Aadhaar card linked to a mobile number is eligible to use eKYC services. NRIs who have lived in India for at least 182 days in the previous 12 months and have an Aadhaar card may also use eKYC for certain services.

5. What are the advantages of eKYC over traditional KYC?

- Speed:

Identity verification is completed within minutes.

- Convenience:

Users can verify identity from anywhere, anytime.

- Cost-Effective:

Reduces the need for physical storage and manual processing.

- Secure:

Uses biometrics and encryption to prevent identity fraud.

- Eco-Friendly:

Eliminates paperwork and reduces carbon footprint.